Molybdenum market update on December 22, 2025

On Monday, the domestic molybdenum market overall maintained relatively weak operation, mainly reflected in slight declines in prices of most products and general enthusiasm among buyers and sellers for entering the market. Today, ferromolybdenum, ammonium tetramolybdate, and molybdenum powder prices decreased by approximately RMB 1,000/ton, RMB 1,000/ton, and RMB 3/kg respectively. According to CTIA GROUP LTD, factors such as significant resistance to upward movement in steel tender prices, abundant spot market supply, and small increase amplitude in international molybdenum prices have jointly led to weak motivation among suppliers to raise quotations. However, supported by production costs, the amplitude of product price declines remained small.

On the news front: On December 15, 2025, Luoyang Molybdenum released an announcement stating that the company's controlling subsidiary Luoyang Molybdenum Holdings Limited and its newly established wholly-owned subsidiary 17536682 Canada Inc. signed an agreement on December 14 with Canadian listed company Equinox Gold Corp. (referred to as “EQX”) and its wholly-owned subsidiary Leagold Mining Corporation. CMOC Limited plans to acquire 100% equity in Leagold LatAm Holdings B.V. and Luna Gold Corp. under EQX for USD 1.015 billion, thereby obtaining gold mine projects, including 100% interests in the Aurizona gold mine, RDM gold mine, and Bahia mining complex.

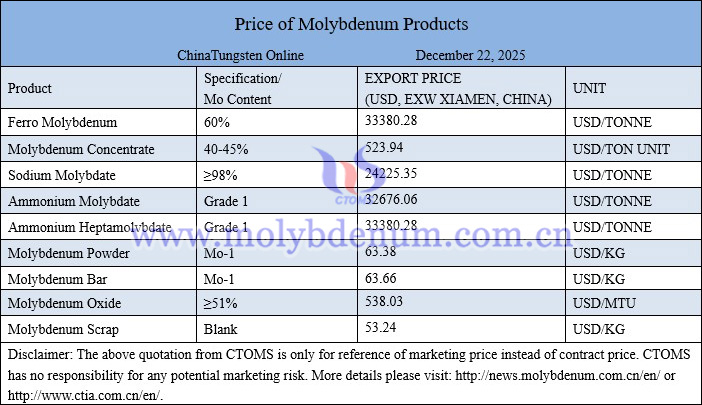

Price of molybdenum products on December 22, 2025

Images of molybdenum crucible