Rare earth market update on December 30, 2025

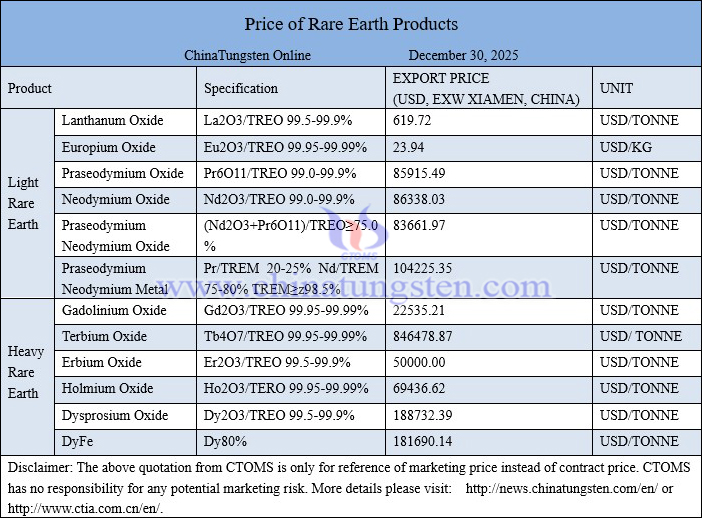

The domestic light and heavy rare earth markets performed slightly differently. In the light rare earth market, expectations of tightening raw material supply and strong reluctance among suppliers to sell while holding bullish sentiment prompted obvious price increases for praseodymium-neodymium metal products, thereby driving praseodymium-neodymium oxide prices upward, but due to low enthusiasm among magnetic material enterprises for inquiries and procurement, actual transaction volume was low. In the medium and heavy rare earth market, the overall trend continued to remain weak and stable, with low buying interest downstream, insufficient production cost support, and strong cash realization consciousness among suppliers jointly making it difficult for dysprosium-terbium prices to rise; however, affected by the relatively strong operation in the praseodymium-neodymium market and good development in rare earth downstream industries, product price decline amplitudes were small, with individual products such as gadolinium oxide prices even showing slight increases.

On the news front, the "2026 Tariff Adjustment Plan" published on December 30 clearly states that starting from January 1, 2026, provisional tariff rates will be implemented for rare earth-related imported goods. Among them, rare earth metals such as neodymium, dysprosium, terbium, lanthanum, cerium, praseodymium, yttrium, and scandium, as well as battery-grade and non-battery-grade mixed or fused rare earth metals, scandium, and yttrium, have a most-favored-nation tariff rate of 5% and a provisional tariff rate of 0; at the same time, rare earth compounds such as cerium oxide, cerium hydroxide, lanthanum oxide, yttrium oxide, dysprosium oxide, terbium chloride, terbium fluoride, and neodymium carbonate also have a most-favored-nation tariff rate of 5% and a provisional tariff rate of 0.

Price of rare earth products on December 30, 2025

Images of neodymium oxide