Molybdenum market update on January 15, 2026

The domestic molybdenum market as a whole maintains a sideways operation, with buying and selling negotiations showing a slightly stalemated atmosphere under the intertwining of bullish and bearish factors: suppliers have weak willingness to actively lower prices for shipments, while purchasers have low acceptance of high-priced sources. Today, prices of molybdenum concentrate, ferromolybdenum, and ammonium heptamolybdate are consolidating around RMB 4,020/ton degree, RMB 260,000/ton, and RMB 254,000/ton respectively.

From the perspective of bullish factors, first, affected by high energy prices, declining ore grades in mines, and low temperatures, the capacity release pace of some molybdenum mining enterprises has slowed down; second, steel companies have successively entered the market to tender for ferromolybdenum, which to some extent supports suppliers' confidence in holding prices. From the perspective of bearish factors, first, the international molybdenum market is weak, which is not conducive to warming up the domestic molybdenum market; second, with the approaching Spring Festival holiday, downstream users' risk-averse sentiment has risen, and they basically maintain just-in-need procurement.

On the news side: Customs data shows that in 2025, China's cumulative imports of steel were 6.059 million tons, decreased by 756,000 tons year-on-year, a decrease of 11.1%; cumulative exports of steel were 11.9019 million tons, increased by 830,000 tons year-on-year, an increase of 7.5%. Among them, in December, steel imports were 517,000 tons, increased by 21,000 tons month-on-month, an increase of 4.2%; steel exports were 11.301 million tons, increased by 1.321 million tons month-on-month, an increase of 13.2%.

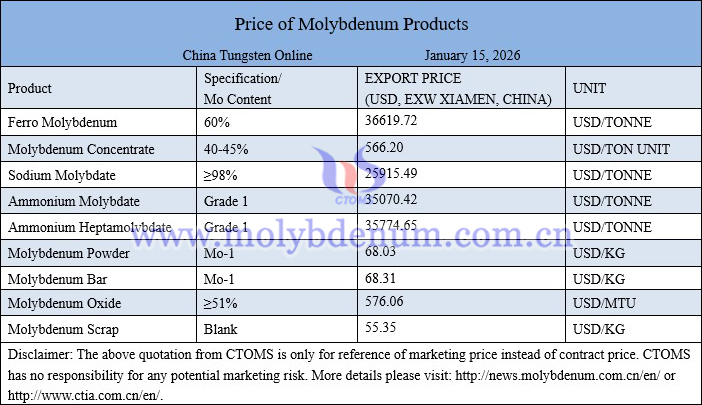

Price of molybdenum products on January 15, 2026

Images of molybdenum copper sheet