Rare earth market update on December 4, 2025

The domestic rare earth market overall showed a general downward trend, mainly due to slow downstream demand follow-up and gradual consumption of bullish factors. Today, praseodymium-neodymium oxide, praseodymium-neodymium metal, terbium oxide, and dysprosium-iron alloy prices decreased by approximately RMB 8,000/ton, RMB 15,000/ton, RMB 20,000/ton, and RMB 10,000/ton respectively.

In the light rare earth market, current praseodymium-neodymium prices remain at relatively high levels, downstream enterprises have limited working capital, and there are many long-term agreement orders, resulting in low trading activity in the spot market, few transactions, and the phenomenon of prices surging briefly before retreating. In the medium and heavy rare earth market, the overall pattern was weak and downward, with low enthusiasm for stockpiling among downstream users, insufficient confidence among industry players in the future market, and relatively strong willingness among some suppliers to trade volume for price, leading to further price declines for dysprosium-terbium, but supported by production costs, the room for price declines remained small.

On the news front, on December 1, 2025, the Critical Minerals & Energy Innovation (CMEI) Office of the U.S. Department of Energy (DOE) released a Notice of Funding Opportunity (NOFO) offering up to $134 million to strengthen the domestic rare earth supply chain. This funding will specifically support projects that can demonstrate the commercial viability of “recovering and refining rare earth elements from unconventional feedstocks (including mine tailings, electronic waste, and other waste streams)”.

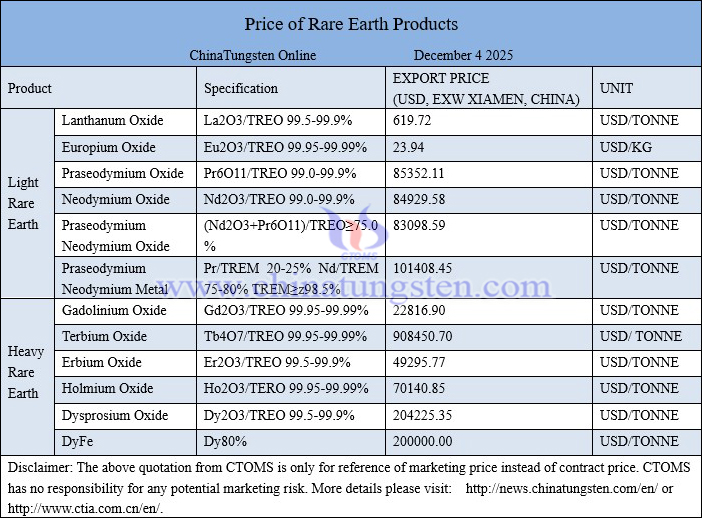

Price of rare earth products on December 4, 2025

Images of neodymium oxide