Rare earth market update on December 9, 2025

The domestic rare earth market overall showed a mixed pattern of rises and falls, with praseodymium-neodymium oxide and praseodymium-neodymium metal prices increased by approximately RMB 3,000/ton and RMB 5,000/ton respectively, while dysprosium oxide prices decreased by approximately RMB 10,000/ton. In the light rare earth market, a strong wait-and-see atmosphere prevailed overall. Although downstream demand followed up slowly, affected by production cost support and limited increase in spot market supply, mainstream suppliers tentatively raised quotations. According to CTIA GROUP LTD, some praseodymium-neodymium oxide producers in Jiangxi, Guangdong and other regions entered shutdown status in October, further restricting market supply release. In the medium and heavy rare earth market, the trend was weak, with dysprosium-terbium prices declining in a consolidating manner amid low enthusiasm among buyers to enter the market for consumption and relatively strong willingness among some suppliers to trade volume for price.

On the news front, customs data show that from January to November 2025, China’s cumulative rare earth imports totaled 91,110.9 tons, decreased by 26.1% year-on-year, with cumulative import value of RMB 11.26 billion, increased by 9.0%; cumulative rare earth exports totaled 58,193.1 tons, increased by 11.7% year-on-year, with cumulative export value of RMB 3.21 billion, increased by 0.9%.

In November 2025, China’s rare earth imports totaled 5,221.0 tons, decreased by 25.32% month-on-month and decreased by 53.91% year-on-year; import value was RMB 900 million, decreased by 7.78% month-on-month and increased by 18.57% year-on-year. Rare earth exports totaled 5,493.9 tons, increased by 26.49% month-on-month and increased by 24.42% year-on-year; export value was RMB 350 million, decreased by 12.50% month-on-month and increased by 34.62% year-on-year.

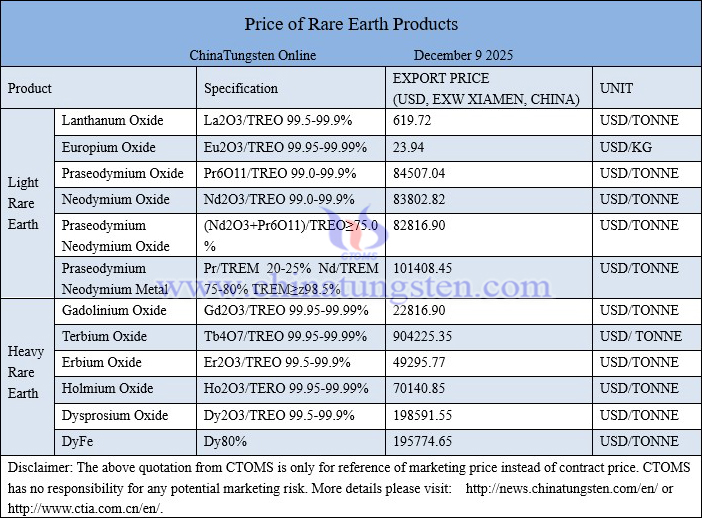

Price of rare earth products on December 9, 2025

Images of erbium oxide